How Do I Trade Carbon

Carbon credits are permits to emit greenhouse gases that can be traded in the international market. If a company produces a lot of greenhouse gas emissions, it can purchase extra allowances on the market. The number of allowances that a business can purchase depends on the amount of greenhouse gas it produces and the quotas it is required to meet. The prices for carbon credits vary by market.

One way to trade carbon credits is through a compliance market. This is a type of market that sets quotas on the emissions of various sectors. Countries set quotas for local businesses and other organizations. In this way, companies are required to reduce their emissions. The price for a quota is determined by the supply and demand of the economy.

Another way to trade carbon credits is through the voluntary market. This has increased significantly due to the interest in climate action and corporate net-zero goals. In this case, a company with a factory and a delivery truck fleet would have to purchase a certain number of carbon credits each year. For instance, a company with a factory and 10 delivery trucks would have to purchase 11 carbon credits each year.

How Do I Trade Carbon Credits?

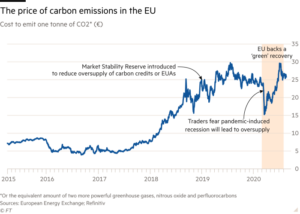

The market for these allowances is governed by governmental agencies. These organizations regulate the market to ensure that quotas are met. Currently, the price of carbon credits is quoted in euros or dollars per metric ton of CO2 emissions. This market provides a spot market for delivery and futures markets for longer-dated deliveries.

The Kyoto Protocol outlined a framework for a global carbon credit system. Under the Kyoto Protocol, developing countries that ratified the protocol were required to validate their carbon projects through United Nations Framework Convention on Climate Change (UNFCCC) approved mechanisms. The verification process was based on third-party audits.

Several countries have withdrawn from the Kyoto Protocol. These include the U.S., the United Kingdom, and France. Nevertheless, the EU Emissions Trading Scheme and the California Emissions Trading System provide the opportunity for companies in these countries to buy and sell carbon credits.

The UNFCCC also regulates the transfer of carbon credits internationally. To ensure the validity of these transfers, countries must register their emissions and projects through national registries. This is a time-consuming process.

Carbon brokers often serve as middlemen and earn a profit. Redshaw Advisors offers a cost-effective route to the market. They work to help businesses, farmers, landowners, and investors buy and sell carbon credits.

There are many different types of carbon credits. Some are created by agricultural practices or forestry techniques. Others are created by power plants or other industrial enterprises. There are a variety of other greenhouse gasses that can be traded as standard multiples of carbon dioxide.

However, most carbon credits have been developed and created by forestry and agriculture practices. These are called Certified Emission Reductions or CERs. These are verified through the Verra Carbon Standard. This is the most widely used standard for assessing the validity of carbon projects. The standard includes a registry system, independent auditing, and accounting methodologies specific to the type of project.